According to the Income Tax Act 1967 the Payer is liable to make payment by deducting the withholding tax at. Basically homeowners will now just pay the tax for their own parcel their own unit.

Company Secretary Malaysia Duties Services Secretarial Services Company Secretary Secretary Duties

Sales Tax 10.

. Types of import taxes in Malaysia. Import duty is a tax levied on imported goods at the point of entry into Malaysia. The tax incentive given under ITA is in the form of allowance in addition to the capital allowance on qualifying plant and equipment acquired by the company during the ITA.

Currently Malaysia does not have any form of death tax estate duty or inheritance tax. The Most Important Types of Insurance Aug 24 2021 The Ways to Manage Financial Risk Aug 19 2021. There are exemptions from Sales Tax for certain persons eg.

The aforementioned highlighted the. There was an estate duty in place until it was abolished on 1 November 1991. Special classes of income.

Malaysia is a very tax friendly country. There are different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions. A tax exemption is given on 70 of the income to organizations and people involved in the transportation of business cargo through Malaysian ships.

Non-residents are subject to withholding taxes on certain types of income. Cukai taksiran is a much more familiar term for this type of tax. Malaysias taxes are assessed on a current year basis and are under the self-assessment system for all taxpayers.

Excise duty is a type of tax. There are 5 different property taxes in Malaysia. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and.

Malaysia is one of the countries who implements territorial tax systemIn laymans term any income accrued in or derived within Malaysia is liable to tax. In Malaysia the most major direct tax is income tax. A specific Sales Tax rate eg.

How to Set Up Malaysia Tax. Contract payment for services done in Malaysia. The standard VAT rate in China is 13.

Other income is taxed at a rate of 30. If a Malaysian or foreign national knowledge worker resides in the Iskandar. Malaysia is one of the countries who implements territorial tax system - basically any income accrued in or derived within Malaysia is liable to tax.

Interest paid by approved financial institutions. The amount of duty payable is based on the. Heres an overview of the type.

Value-Added Tax VAT rates. 030 Malaysian ringgits MYR per litre is applicable to petroleum products. SPA Stamp Duty Memorandum of Transfer aka MOT Loan Agreement Stamp Duty Cukai Taksiran Cukai Tanah and Real.

In the main dashboard of Deskera Books click on the Products on. Youll be taxed if you gain profit from renting a house land vehicle or even goods used by someone where you receive money in return. Income tax comparably low and many taxes which are raised in other countries do not exist in Malaysia.

Service Tax 6. Payment Types and Rates for Withholding Tax in Malaysia. 14 Income remitted from outside Malaysia.

There are two types of taxes. Like the Malaysian Sales and Services Tax SST VAT is levied on imports from any location into China. Income and other taxes.

Malaysia Personal Income Tax Guide 2021 Ya 2020

Image Result For Malaysia Simplify Membership Form Format In Word Signs Youre In Love Words Free Business Card Design

What Is Tax Residence And Why Does It Matter

How To File Your Taxes For The First Time

Boat Sale And Purchase Agreement Template Nz The Seven Secrets About Boat Sale And Purchase Cars For Sale Project Cars For Sale Sell Car

Malaysia Sst Sales And Service Tax A Complete Guide

6 Differences Between Sole Proprietorship And Sdn Bhd In Malaysia Tetra Consultants

Genuine Casio Ms 6nc We Mini Desk Type Calculator Solar Battery 2 Way Power 8 Digits Label Printer Colorful Calculators Camera Watch

Cukai Pendapatan How To File Income Tax In Malaysia

7 Tips To File Malaysian Income Tax For Beginners

Holding Company In Malaysia Benefits Activities Setup Tax Holding Company Company Benefits Activities

Malaysia Personal Income Tax Guide 2021 Ya 2020

Updated Guide On Donations And Gifts Tax Deductions

Types Of Income You Need To Know Income Incometax Incomeproperty Incomeopportunity Incomeinequality Trading T Trading Signals Day Trading Income Property

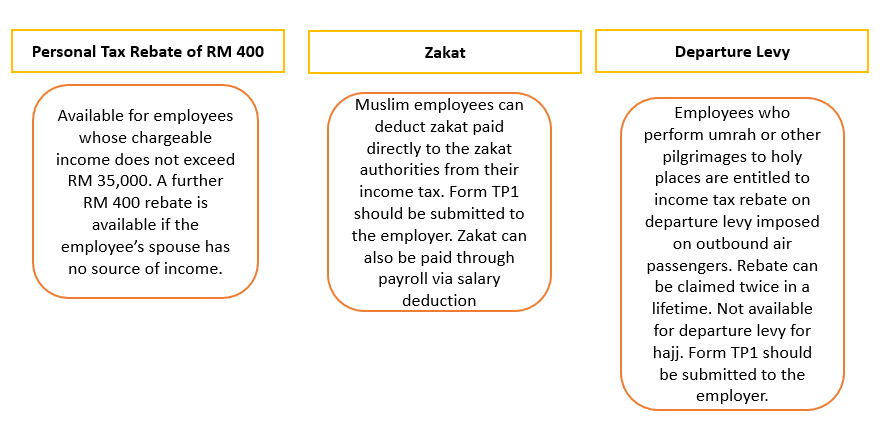

Everything You Need To Know About Running Payroll In Malaysia

Backpacking Malaysia Singapore 5 Day Itinerary Cost Breakdown Highlights 2018 Vinz Ideas Discovering Asia On A Budget

Malaysia Free Trade Zones All You Need To Know Tetra Consultants

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important